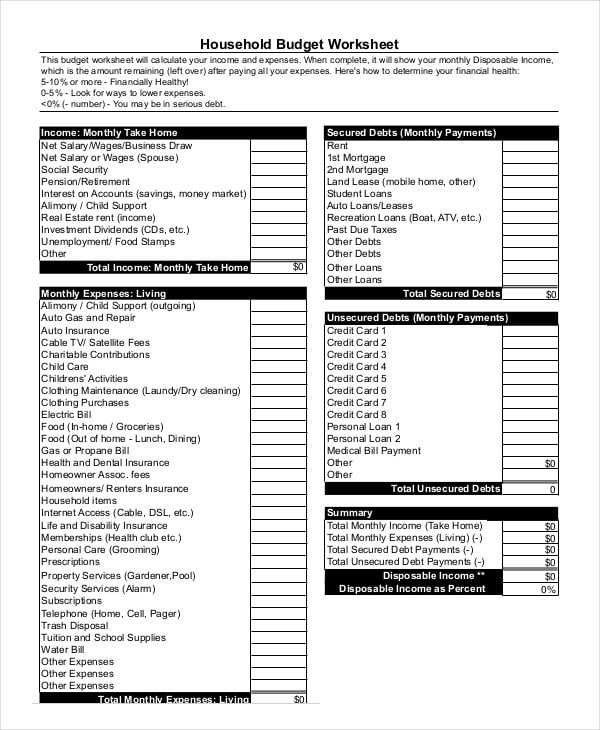

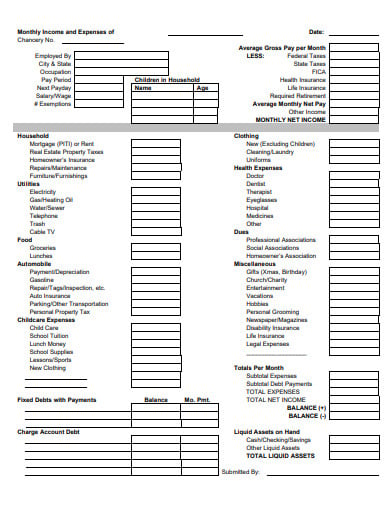

If you never see the money, you won't miss it. This is the most effective way to save money. Pay yourself first by putting a portion of your paycheck directly into the bank.Ways to Saveĭon't know where to start? Need ideas on new ways to save money. If you want to put more money into your savings, you must reduce your living expenses and/or decrease your debt. For example, if you spend 75% of your income on living expenses, reduce the amount you put into your savings by 5%. This means dividing up your income into three chunks, with 50 being allocated to essential items. If you exceed these percentages in any category, reduce your spending in the other areas. One very simple way to budget is to follow the 50 30 20 rule. The default date range is current year-to-date, but set it to whatever you want (Last Month, Last Quarter. In the Create Summary Report panel, leave the selections on the defaults -RowCategory, ColumnTime, IntervalNone - and click Continue to Customize. 10% for debt (student loans, car payments, credit cards) In this case, wanting a simple income & expense, you would select Create Summary Report.5% for specific goals (vacation, car, school tuition, a new computer).5% for emergencies (car repairs, medical expenses, unemployment).Emergencies: Set aside 1,000 in the bank right away. (Credit for the 50/30/20 rule goes to Senator Elizabeth Warren, who reportedly used to teach it when she was. According to the popular 50/30/20 rule, you should reserve 50 of your budget for essentials like rent and food, 30 for discretionary spending, and at least 20 for savings. Since budget percentages for these can vary, let’s talk through each one. Many sources recommend saving 20 of your income every month. 10% for retirement ( IRA, 401(k), company pension) How much you’re putting in savings each month depends on several factors When it comes to the savings category of your budget, think about these three reasons to save: emergencies, big purchases and wealth building.70% for living expenses (rent, food, clothing, gasoline).Statutory or mandatory labor burden includes Social Security tax, Medicare tax, federal and state unemployment. For example, if the annual benefits and payroll taxes associated with an individual is 20,000 and his wages are 80,000, then the burden rate is 0.25 per 1.00 of wages. For the year ended June 2020, 17. Divide your income in the following manner: The two situations in which the burden rate is used are: Labor. In the year ended June 2020, for every 100 dollars of disposable income in households, 21 dollars was spent on housing costs. One easy way to save is to follow the 70-20-10 Rule. Putting away at least 10 percent of your take-home income in a. Believe it or not, it IS possible to save for short-term and long-term goals, emergencies, and even retirement. Determine how much you can save each month, and make sure that is the first money you move.

The concern with placing your emergency savings in mutual funds, stocks or other assets is that they may lose value if the funds need to be accessed quickly.Most people agree that saving is a good thing, but they find it difficult to do. Fooding 1000 SGD Restaurant 1000 SGD Water 50. net income would be around 3.6k.So as per survey monthly expense will be as below. the median monthly gross income in sg is 4.5k including compulsory govt CPF (equivalent of 401k) deductions of 20. Where should you put the money?Įmergency savings are best placed in an interest-bearing bank account, such as a money market or interest-bearing savings account, that can be accessed easily without taxes or penalties. Mortgage Interest Rate in Percentages (), Yearly, for 20 Years Fixed-Rate : 2.12: 1. You may also want to consider adjusting the amount based on your bill obligations, family needs, job stability, or other factors. This amount can seem daunting at first, but the idea is to put a small amount away each week or two to build up to that goal. While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months’ worth of expenses. Instead, this fund serves as a safety net, only to be tapped when an emergency occurs. It shouldn’t be considered a nest egg or calculated as part of a long-term savings plan for college tuition, a new car, or a vacation. What is an emergency fund?Īn emergency fund is a separate savings or bank account used to cover or offset the expense of an unforeseen situation. While emergencies can’t always be avoided, having emergency savings can take some of the financial sting out of dealing with these unexpected events. A sudden illness or accident, unexpected job loss, or even a surprise home or car repair can devastate your family’s day-to-day cash flow if you aren’t prepared. When they happen, they can derail your financial stability. Emergencies, by their nature, are unpredictable.

0 kommentar(er)

0 kommentar(er)